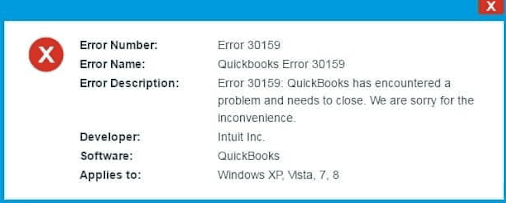

QuickBooks error 30159 is a payroll error that occurs when you try to upgrade the payroll. This error shows a warning message: “QuickBooks has encountered a problem and needs to close.” Payroll errors in QuickBooks are rare.

You may see this error when adding an existing payroll subscription to your QuickBooks account. The error can also happen because of misconfigured system files in Windows. Fixing it quickly helps avoid more problems.

Struggling With Accounting or Bookkeeping?

Talk to our experts in minutes — No wait time!

- Free Consultation

- Fast Response

- Trusted Experts

Table of Contents

- 1 How to Fix QuickBooks Payroll Error 30159?

- 1.1 Solution 1: Check the Status of Your Payroll Subscription

- 1.2 Solution 2: Fixing the Paysub.ini File

- 1.3 Solution 3: Check the Details of the Employer Identification Number (EIN).

- 1.4 Solution 4: Download and Launch the Program Diagnostic Application QuickBooks Tool Hub.

- 1.5 Solution 5: Fix QuickBooks Error 30159 by Updating QuickBooks

- 1.6 Solution 6: Set Up Windows Updates

- 1.7 Solution 7: Utilizing the File Checker on Windows

- 2 Main Causes of QuickBooks Payroll Error 30159

- 3 Conclusion

- 4 Frequently Asked Questions

- 4.1 Q 1: How can I avoid getting QuickBooks Error 30159?

- 4.2 Q 2: Can reinstalling QuickBooks fix Error 30159, and how often should I back up my data before trying this?

- 4.3 Q 3: Is it possible for QuickBooks Error 30159 to arise on both Mac and Windows platforms?

- 4.4 Q 4: When filing taxes, what should I do if I run into QuickBooks Error 30159?

- 4.5 Q 5: Might issues with my internet connection be connected to QuickBooks Error 30159?

How to Fix QuickBooks Payroll Error 30159?

Solution 1: Check the Status of Your Payroll Subscription

An important factor contributing to the QuickBooks Error Code 30159 is an inactive payroll subscription. In order to correct the problem, you must confirm the status of your subscription.

Use the procedures listed below to do this:

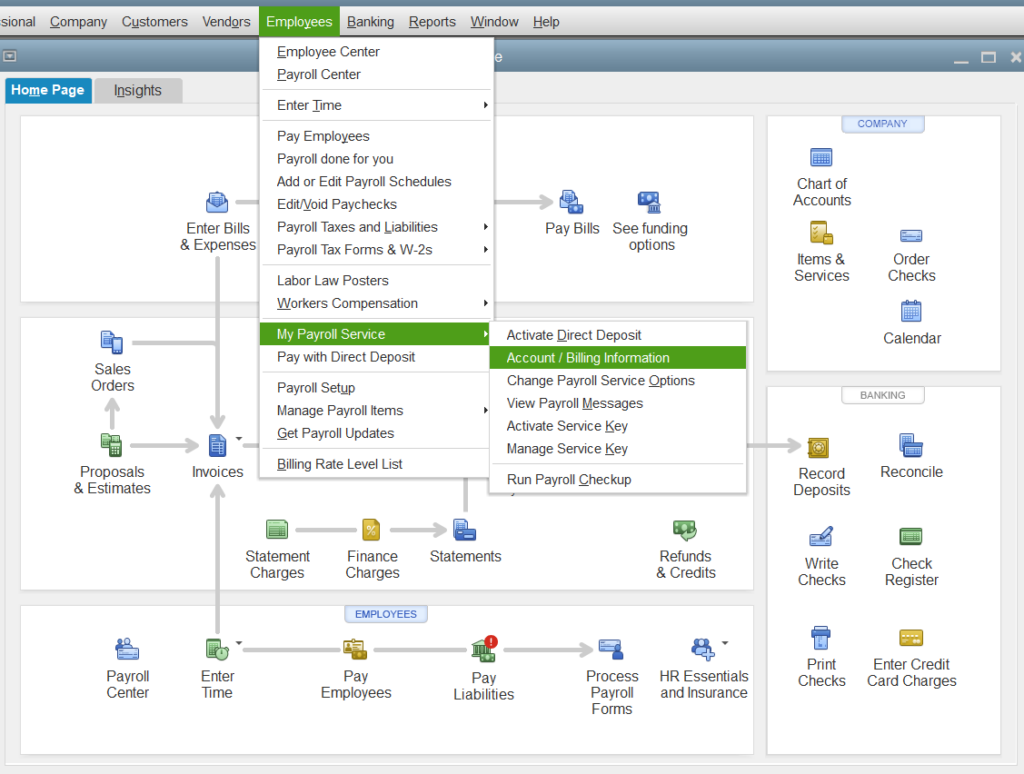

- Launch the QuickBooks Desktop software first. Then, choose “My Payroll Services” from the top section’s “Employees” option, and then click “Account and Billing Info.”

- Enter your login information next, and then click “Sign In.”

- Choose your favorite way to prove who you are in the “Confirm your account information” page.

- An email or confirmation code will be sent to your phone number. Click “Continue” once you have it.

- Press “Continue” after entering the 6-digit confirmation code you were given in the “Enter your confirmation code” window.

- Check to see whether Error 30159 has been fixed by updating your payroll tax tables again once you’ve successfully logged in. Proceed to the following stage of troubleshooting if the issue persists.

Solution 2: Fixing the Paysub.ini File

- First, select the View tab by opening the file explorer.

- Unlock Hidden Folders and Files.

- Find the file Paysub.ini.

- Add.old to the end of this file’s name to rename it.

Note: QuickBooks will no longer be able to use the file. Therefore, the accounting software will create a new file for usage immediately when the user launches it. In the end, it will fix error code 30159 in QuickBooks.

Solution 3: Check the Details of the Employer Identification Number (EIN).

Error 30159 in QuickBooks can be caused by incorrect EIN data. Checking and updating this data is an essential first step.

Follow these steps:

- Launch QuickBooks and choose the Employees option.

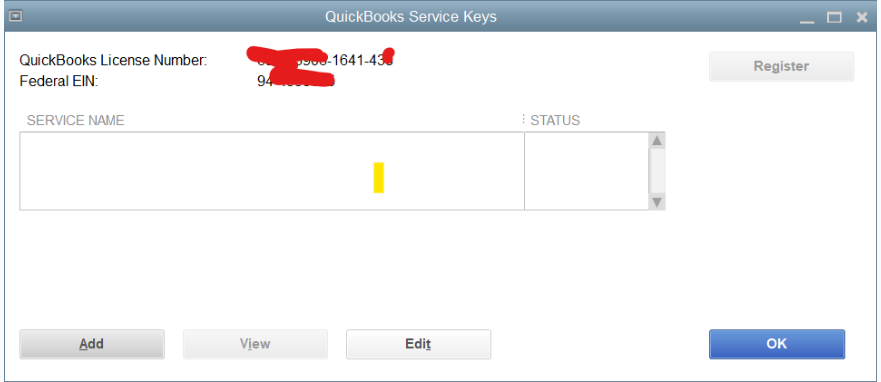

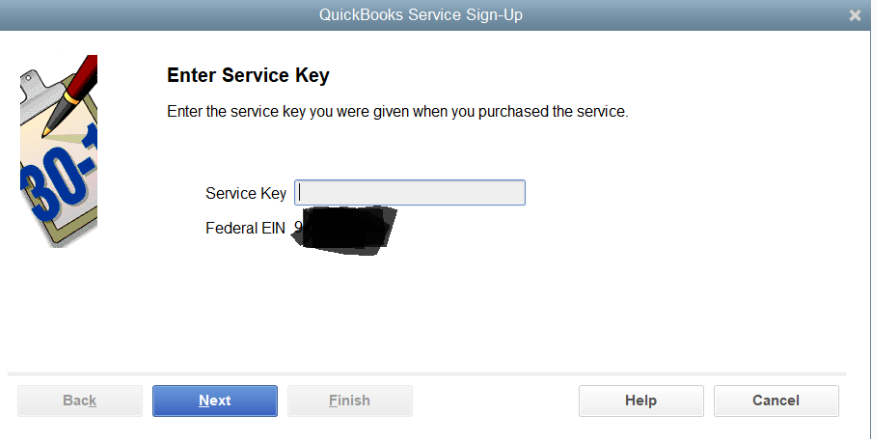

- Following the selection of “My Payroll Service,” select “Manage Service Key.”

- Make sure the Employer Identification Number (EIN) you have on file is accurate.

- To change the EIN if it is inaccurate, get in touch with the payroll service provider.

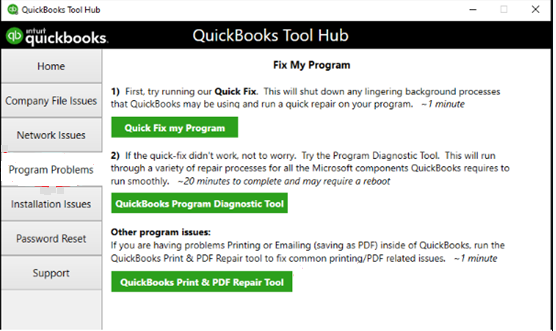

Solution 4: Download and Launch the Program Diagnostic Application QuickBooks Tool Hub.

One of the tools in the QuickBooks Tool Hub is the Program Diagnostic tool, which is useful for resolving Error 30159. This method entails scanning and fixing problems with payroll. Put these actions into action:

- The QuickBooks Tool Hub may be downloaded and installed from the official Intuit website.

- Close QuickBooks before executing the tool.

- Open the QuickBooks Tool Hub and pick the “Program Problems” option.

- Select the “QuickBooks Program Diagnostic Tool” option, and then give it some time to finish.

- If any problems are discovered, take the necessary steps to resolve them.

- After the diagnosis is finished, exit the tool hub and verify that the QuickBooks Error 30159 has been eliminated.

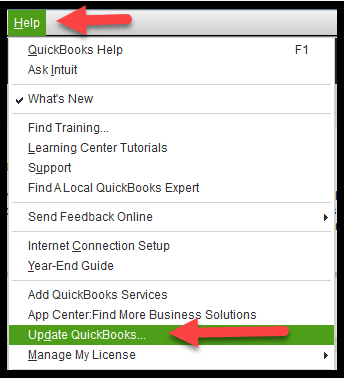

Solution 5: Fix QuickBooks Error 30159 by Updating QuickBooks

Error 30159 is frequently caused by outdated QuickBooks software. One simple yet efficient way to fix this error is to make sure your QuickBooks is up to date. This is how to make updates to QuickBooks:

- Make sure all QuickBooks-related processes are terminated before closing QuickBooks.

- Choose “Run as administrator” by doing a right-click on the QuickBooks Desktop icon.

- Select “Update QuickBooks” from the Help menu.

- Click the “Update Now” tab in the Update QuickBooks window.

- To erase past updates, check the “Reset Update” box.

- To begin the updating process, click the “Get Updates” button.

- After the update is finished, exit and then reopen QuickBooks. Verify whether you continue to receive the QuickBooks Payroll Error 30159.

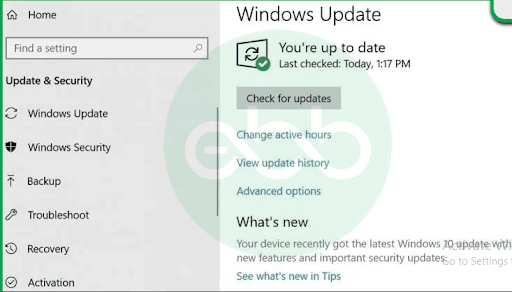

Solution 6: Set Up Windows Updates

- To get started, click Start, enter “update” in the search box, and then press Enter.

- The system will display any available changes on the search results page.

- Install each of these updates, and after the process is finished, restart the computer.

Solution 7: Utilizing the File Checker on Windows

- Use your system administrator login to access the system.

- Hit the Windows+R keys. The run box will appear.

- Following that, type cmd and hit Enter.

- Type scannow/sfc and hit Enter when the black window opens.

- A few seconds later, the procedure will be finished. Proceed with the remaining instructions and fix the issues found in the system files.

Main Causes of QuickBooks Payroll Error 30159

QuickBooks error 30159 can happen due to technical issues like problems with the EIN number or the paysub.ini file.

Here are the key reasons:

- Your payroll subscription has expired.

- More than one active payroll agreement exists with an inactive Direct Deposit agreement.

- The paysub.ini file in QuickBooks Desktop is damaged.

- Your company data is corrupted.

- You are using an outdated QuickBooks version.

- Your service key is incorrect.

- The Employer Identification Number (EIN) in the company file is wrong.

- The PSID in your company file is wrong.

- Your QuickBooks Desktop version does not work with your Windows version.

- The payroll subscription status in QuickBooks Desktop Service Keys shows “Invalid number or EIN.”

- The EIN you want to add was previously registered.

Conclusion

QuickBooks error code 30159 usually affects Windows and compatible software. Following the suggested steps can resolve the issue easily. If the error persists, it’s recommended to contact QuickBooks payroll support for expert assistance. You can consult our U.S.-based accounting specialists for further help.

Frequently Asked Questions

Q 1: How can I avoid getting QuickBooks Error 30159?

Ans: Keep QuickBooks and Windows updated, run antivirus scans, use a stable internet connection, avoid multiple versions, and back up data regularly.

Q 2: Can reinstalling QuickBooks fix Error 30159, and how often should I back up my data before trying this?

Ans: Yes, Error 30159 can be fixed by reinstalling QuickBooks if the problem stems from a software installation. To avoid losing data, you must make a backup of your data before trying to reinstall QuickBooks.

Q 3: Is it possible for QuickBooks Error 30159 to arise on both Mac and Windows platforms?

Ans: Although Error 30159 is frequently reported on Windows, comparable payroll issues can also occur on Mac. There may be a small variation in the troubleshooting procedures for Mac, such as using the Mac App Store to check for software updates.

Q 4: When filing taxes, what should I do if I run into QuickBooks Error 30159?

Ans: Make sure your QuickBooks and payroll tax tables are current if you run into Error 30159 when submitting your taxes. If the issue continues, try running the Program Diagnostic Tool through the QuickBooks Tool Hub and, if necessary, get in touch with QuickBooks support.

Q 5: Might issues with my internet connection be connected to QuickBooks Error 30159?

Ans: An unstable or unreliable connection might impede payroll updates and result in QuickBooks Error 30159, even if it is not directly related to internet connection problems. When doing updates or payroll procedures, make sure your connection is steady.