Certain problems often come up for QuickBooks users, as it is used in business accounting. Among these, QuickBooks Error 557 stands out as a common disruptor, primarily impacting payroll functionalities. This error means the payroll system isn’t working because the subscription is out of date or there was a problem transferring new updates. Such a problem may stop important payroll actions and cause chaos for a business until it can get things back on track. Knowing what causes problems and how to solve them is vital for steady financial administration.

Table of Contents

- 1 What is QuickBooks Error 557?

- 2 How to Fix QuickBooks Payroll Error 557?

- 2.1 Solution 1: Verify Active Payroll Subscription

- 2.2 Solution 2: Update QuickBooks to the Latest Version

- 2.3 Solution 3: Repair QuickBooks Desktop via Control Panel

- 2.4 Solution 4: Run QuickBooks File Doctor

- 2.5 Solution 5: Manual Update of Payroll Tax Tables

- 2.6 Solution 6: Perform a Clean Install

- 2.7 Solution 7: Delete the EntitlementDataStore File

- 2.8 Solution 8: Enter QuickBooks Service Key

- 2.9 Solution 9: Make necessary changes to the windows registry

- 2.10 Solution 10: Use Windows Safe Mode for Updates

- 2.11 Solution 11: Check System Firewall or Antivirus Conflicts

- 3 Why Does Error 557 Occur in QuickBooks?

- 4 Symptoms of QuickBooks Payroll Error 557

- 5 Preventive Tips to Avoid QuickBooks Error 557

- 6 Conclusion

- 7 Frequently Asked Questions

- 7.1 Q 1: What is the most common reason for QuickBooks Error 557?

- 7.2 Q 2: Am I able to use the payroll service if I have Error 557?

- 7.3 Q 3: How long does it take to fix QuickBooks Error 557?

- 7.4 Q 4: Is there any chance that Error 557 could harm my existing payroll information?

- 7.5 Q 5: What should I do if I’ve tried everything and the Error 557 still appears?

- 7.6 Q 6: Can Error 557 be solved with QuickBooks File Doctor?

- 7.7 Q 7: Could slow internet speed be the reason I keep getting Error 557?

- 8 Adams Williams

What is QuickBooks Error 557?

QuickBooks Error 557, at its core, is a QuickBooks payroll update error that prevents QuickBooks Desktop from successfully retrieving and applying the latest tax table updates. Users will usually receive a message much like the following.

Error: Payroll update in QuickBooks could not be completed. You should try again sometime later. Error 557.”

You might experience this error as part of a regular QuickBooks Desktop upgrade, but it is most familiar when payroll tools are being updated. The code ‘557’ is given when there is a problem with the connection from QuickBooks to Intuit servers that update the payroll tax tables. It might happen because you lack authorization (because your subscription has expired), your update file is damaged, or other software or system settings are interfering.

It becomes very important because it can make the payroll process go wrong. Businesses that do not update their tax tables may calculate taxes incorrectly, which can result in compliance problems, fines, and incorrect payments for their staff. This makes resolving Error 557 QuickBooks Desktop a high-priority task for any business reliant on QuickBooks for payroll management.

Struggling With Accounting or Bookkeeping?

Talk to our experts in minutes — No wait time!

- Free Consultation

- Fast Response

- Trusted Experts

How to Fix QuickBooks Payroll Error 557?

Fixing QuickBooks Error 557 is something that one should approach systematically, from the more common and simpler to the more difficult types of troubleshooting. In other words, one should successfully fix error 557 in QuickBooks.

Solution 1: Verify Active Payroll Subscription

This is the most crucial first step and often the resolution to the QuickBooks payroll update error. Payroll updates in QuickBooks are offered for a fee, so an active plan is needed at all times.

- Log in to your Intuit Account

Open the Intuit website at https://quickbooks.intuit.com/ and enter your account username and password.

- Check Subscription Status

Find the area labeled “Products & Services” or “My Account.” Get to your QuickBooks Payroll subscription and make sure it’s active.

- Ensure Active and Paid

Check if the subscription works and if there are no problems with billing. If you find that your driver’s license is no longer valid, you have to renew it.

- Update Billing Information (if necessary)

If there are problems with your payment options, adjust your billing information.

- Re-attempt Payroll Update

After fixing your subscription problems, open QuickBooks Desktop and attempt updates on the payroll tax tables.

Note: It is common for a subscription to take several hours to fully connect with Intuit after activation or renewal. After renewing, take a bit of time before you try the update again.

Solution 2: Update QuickBooks to the Latest Version

An outdated QuickBooks Desktop application can sometimes be incompatible with the latest payroll update protocols, contributing to the QuickBooks payroll update error. Keeping your QuickBooks up-to-date helps keep your business stable and safe.

- Open QuickBooks Desktop

Open QuickBooks Desktop from your computer.

- Go to Help Menu

Choose the “Help” menu at the top.

- Click on the “Update” button for QB Desktop.

Click the option from the menu to choose it.

- Select the “Update Now” Button

When you reach the Update QuickBooks Desktop window, check that the “Update Now” tab is there.

- Check “Reset Update” (Optional but Recommended)

A good practice before downloading again is to tick the “Reset Update” box before hitting “Get Updates.”

- Click “Get Updates”.

At this point, the newest QuickBooks Desktop updates will start downloading.

- Restart QuickBooks

When the download finishes, go ahead and close the program and then start QuickBooks again. You will see a notification telling you to install the updates. Press “Yes” to continue.

The system is blocked from the usual role because your last submission was rejected.

- Re-attempt Payroll Update

Once you’ve restarted QuickBooks and the updates have been applied, update your payroll tax tables.

Solution 3: Repair QuickBooks Desktop via Control Panel

If the QuickBooks installation files themselves are damaged, a repair can fix error 557 QuickBooks without requiring a full reinstallation.

- Close QuickBooks Desktop

- Make sure all QuickBooks windows are closed before beginning.

- Access Control Panel

- Windows 10/8: If you have a Start button, click it, then choose Control Panel by right-clicking; if you don’t have a button, search for Control Panel in the search bar.

- You will have to click the Start button in Windows 7/Vista and after that select the option of Control Panel.

- Go to Programs and Features:

- Category View: Go to the Programs section, then choose “Uninstall a program” under it.

- For Icon View, click on “Programs and Features.”

- Find QuickBooks

- You should see “QuickBooks Desktop” among the list of installed programs.

- Click the right button and pick “Repair”

- Choose QuickBooks Desktop on your computer and choose the option “Repair.” Should “Repair” not show up, click “Change” and then pick “Repair” from the following options.

- Follow On-Screen Prompts

- Work on fixing the issue will start. This process may go slowly. Carry out any guidance you are provided on the screen.

- Restart Computer

- As soon as the repair is done, you should restart your computer.

- Re-attempt Payroll Update

- Lunch your QuickBooks and start to update your payroll tax information.

Solution 4: Run QuickBooks File Doctor

QuickBooks File Doctor is a free utility from Intuit made to detect and fix typical problems with QuickBooks data and networks. While primarily for company file issues, it can sometimes resolve underlying problems that affect payroll updates, thus helping to fix error 557 in QuickBooks.

- Download and Install

If you haven’t downloaded it, head to the official Intuit website and get QuickBooks Tool Hub (which contains File Doctor). Put the program on your computer.

- Access the QuickBooks Tool Hub

To open the QuickBooks Tool Hub, you need to double-click its icon on your desktop twice.

- Select “Company File Issues”

Using the Tool Hub, click on the link titled “Company File Issues.”

- Run QuickBooks File Doctor

On the pop-up window, click on “Run QuickBooks File Doctor.” When you launch it, the tool will open.

- Go to the Company File.

Open QuickBooks File Doctor, pick ‘Company File’ from the dropdown, select your file, and then press ‘OK’. If you can’t find it, select the “Browse” option.

- Browse to Check your file (or Company File and Network Problems )

Select the option that seems the most relevant to your specific issue.

- Enter Admin Password

When asked, enter your QuickBooks administrator password.

- Start Repair

Once you click “Continue” or “Next,” the diagnostic and repair will start. How much time it takes largely depends on the size of your company file.

- Restart Computer

After File Doctor is finished, go ahead and restart your PC.

- Re-attempt Payroll Update

Lunch your QuickBooks and start to update your payroll tax information.

Solution 5: Manual Update of Payroll Tax Tables

When automatic updates are failing, a manual one might bypass an existing issue with the QuickBooks payroll update error. You should download the updated tax table directly from the Intuit website.

- Check the Version of QuickBooks You Have

Click “Help” on the menu in QuickBooks Desktop and then choose “About QuickBooks Desktop.” Make a note of what version of QuickBooks you are using by selecting QuickBooks Desktop Pro 2024.

- Visit Intuit’s Manual Payroll Update Page

Visit the official Intuit site in your browser to perform manual updates to your payroll. Entering “QuickBooks manual payroll update” into a search engine will take you to the right page.

- Download the Latest Update

Open QuickBooks Save Your Files and select your version of QuickBooks Desktop and the proper year. Download the latest file for the payroll tax table. Most likely, an .exe file is what you’ll receive.

- Close QuickBooks

Be sure to close QuickBooks Desktop before you start running the update file you’ve just downloaded.

- Run the File You Have Downloaded

Find the .exe file where you downloaded it and double-click to start the update.

- Follow On-Screen Instructions

You will use the update wizard to install the software step by step.

- Restart Computer

Following the installation, turn off your computer and start it again.

- Verify Update in QuickBooks

Open QuickBooks Desktop on your computer. Go to the Employees menu and click on Get Payroll Updates. You should notice the “You have the latest payroll tax table” note or you will find the latest version number. In case that does not work, try to do the update again in QuickBooks.

Solution 6: Perform a Clean Install

A clean install is a more drastic measure but is effective when other solutions fail, especially if the problem is rooted in deep corruption within the QuickBooks installation, and you need to fix error 557 QuickBooks thoroughly. So, you should first uninstall QuickBooks, then reinstall it once all remaining application files have been cleared away.

- Back up the Company Files.

First, save copies of your company files and custom templates before you start anything else. Keep your data on an external drive or in the cloud.

- Gather Installation Media/License Info

Make sure you can access both your QuickBooks Desktop CD or the downloaded installer and your license and product information. Your license information is available at “Help” > “About QuickBooks Desktop” within your set-up.

- Get rid of QuickBooks Desktop on your PC.

- Close QuickBooks.

- Head to the “Control Panel,” choose “Programs and Features” (as shown in Solution 3).

- Right-click the QuickBooks Desktop icon, then select the choice for “Uninstall.” Answer the questions as they come up in the assessment.

- Use the QuickBooks Clean Install Tool.

- Installing QuickBooks Tool Hub should be your first step if you haven’t already done so.

- Run QuickBooks Tool Hub.

- Head over to “Installation Issues” to begin.

- Click on the link for the QuickBooks Clean Install Tool.

- Do as the on-screen instructions tells you during the tutorial. This tool will clear up any QuickBooks files left over.

- Manually Delete Remaining Files (Optional but Recommended)

- Go to the File Explorer, select C:\ProgramData\Intuit\QuickBooks. Delete any folders with your QuickBooks version name such as “QuickBooks 202X”.

- In addition, look in C:\Program Files\Intuit\QuickBooks and C:\Program Files (x86)\Intuit\QuickBooks to remove any remaining folders and delete them.

- Reinstall QuickBooks Desktop

- Use the guidance shown on the screen for a standard installation.

- When asked, put in your license and product numbers as needed.

- Activating QuickBooks

From the installed draw of the software, execute QuickBooks and start it.

- Recovering Company Files

File > Open or Restore Company > Restore a Backup Copy > Local backup: choose your saved backup file.

- Payroll Update Retry

Once the company file is within reach, remember to update the payroll tax tables.

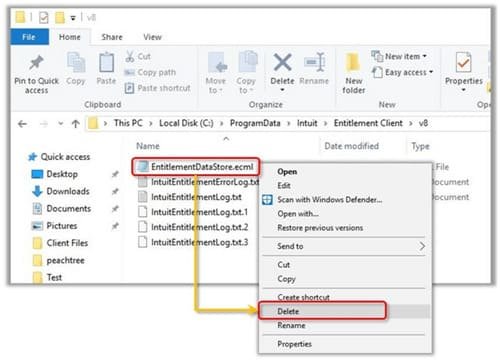

Solution 7: Delete the EntitlementDataStore File

If you are still experiencing QuickBooks error 557, you should delete the entitlement data file in the QuickBooks folder to revalidate the program.

Note: If you are using these steps, you will need to re-enter your license key and product number. This is a simple step to access your product information: Press F2 on your keyboard.

- First, go to the Windows Start menu search and type “Run” to open the Run program.

- After that, copy and paste the given path into the Run box: C:\Program\Data\Intuit\EntitlementClientV8 and press Enter. If you don’t find the folder path, go manually to C:\Program\Data\Intuit\EntitlementClientV6.

- Find the EntitlementDataStore.ecml file. Right-click on this file and select Delete.

- Confirm by selecting Yes.

- Open QuickBooks and follow the on-screen instructions to re-register it.

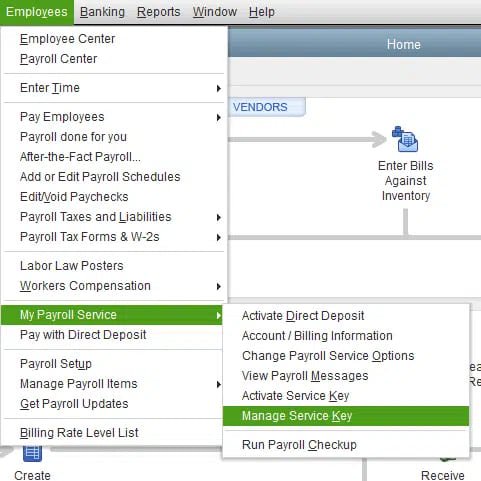

Solution 8: Enter QuickBooks Service Key

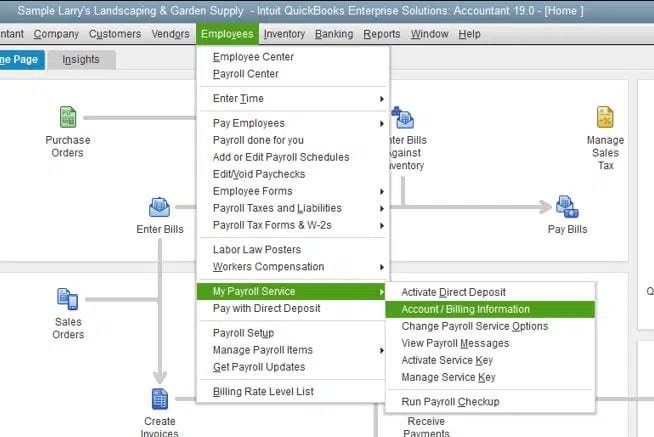

- First, open QuickBooks Desktop.

- After that, go to the Employee menu and click on My Payroll Services. Then, choose Manage Service Keys.

- After that, the user needs to select the Edit tab at the bottom of the QuickBooks Service Key window.

- After doing so, make a note of the service key, and go to the add tab.

- Now, enter the Service Key.

- Then, click on the Next tab and click on the Finish tab.

- Now, switch to the OK tab on the Payroll Update message.

- Finally, make sure the Service Status appears Active.

- Finish the process by clicking on the Next tab and checking if the issue is resolved.

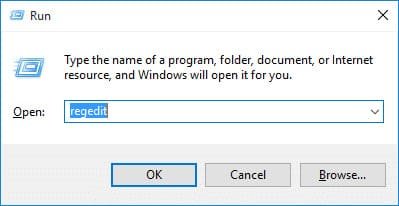

Solution 9: Make necessary changes to the windows registry

- Start the system and type the command in the Search box

- Hold down the Ctrl + Shift key and press Enter

- Now you will be taken to the permission panel

- Click Yes

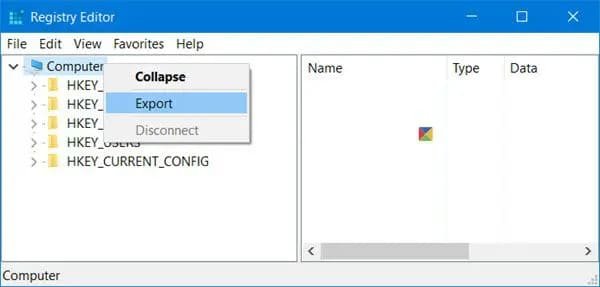

- The recording machine will open with a blinking indicator. So, type ‘regedit’ and click Enter.

- Select the Error 557-Related Key in Written Record Editor

- Select Export from the File menu

- In the Save to list, select the folder in which you want to save the QuickBooks backup key from being wasted

- Type a name for your computer file in the File box Name, for example- QuickBooks Backup

- Make sure ‘Selected Branch’ is selected in the Export Category box

- Click Save

- The file will be saved with the .reg file extension

- Now, you will have a backup of your QuickBooks-related written record entry

Solution 10: Use Windows Safe Mode for Updates

Once in a while, third-party apps running without your knowledge can cause QuickBooks to have updating issues. Booting into Windows Safe Mode starts your computer with only essential programs and drivers, which can help isolate the issue causing the QuickBooks payroll update error.

- Restart your computer in Safe Mode.

- On Windows 10/8, go to Start, click Settings, choose Update & Security, then choose Recovery, go to advanced startup and lastly click Restart now. Following that, select Troubleshoot > Advanced options > Startup Settings > Restart.

- For Windows 7, perform a restart and as the logo is appearing, keep hitting the F8 key several times. After that, you need to Scroll to the Advanced Boot Options section and then choose the option of Safe Mode and Networking.

- Open QuickBooks (if possible)

When your computer is in Safe Mode, go ahead and open QuickBooks Desktop.

- Attempt Payroll Update

Updating your payroll tax tables can be done directly from the QuickBooks software.

- Restart Normally

When the update works correctly in Safe Mode, it shows a conflict with a different program. Shut down your PC as you normally would and then check what new software or services have been installed.

Solution 11: Check System Firewall or Antivirus Conflicts

As mentioned, security software can sometimes block QuickBooks’ access to the internet, preventing updates and contributing to QuickBooks Error 557.

- Temporarily Disable Firewall/Antivirus

- Search in the Start menu for “Windows Defender Firewall,” and then under that, select “Turn Windows Defender Firewall on or off” to temporarily disable it for both public and private computers.

- To learn how to disable antivirus, go to the software’s instructions or manual.

- Begin the process of updating your payroll.

Before commencing the update read, ensure that your security software has already been disabled.

- Enable and Configure Exceptions

As soon as the update has been completed, reactivate your firewall and antivirus. Then configure your security program to include exceptions for QuickBooks Desktop and associated processes.

- Read Security Software Documentation

Every firewall and antivirus is different. For step-by-step instructions, look into the help files or visit the support websites posted by antivirus companies.

Why Does Error 557 Occur in QuickBooks?

The occurrence of QuickBooks Error 557 can be attributed to several underlying factors, often interconnected.

- Expired or Inactive Payroll Subscription

This is the main cause behind haunting. You need a current and active payroll subscription for the software to receive updates. If your subscription is missed or there is a problem with bills, the update request will be rejected by Intuit, showing Error 557.

- An old installation of QuickBooks Desktop

An old QuickBooks Desktop program can occasionally result in problems when using the latest payroll changes. Improvements and bug fixes in QuickBooks are released by Intuit often, and when these are applied, payroll updates usually go smoothly.

- Corrupted QuickBooks Installation Files

There is a possibility that the installation of QuickBooks Desktop is corrupt or not full. Such a problem may be caused by an incorrect shutdown, a hard drive error, or a bad initial installation. When an installation is corrupted, several QuickBooks functions may not work, including payroll updates.

- Damaged Payroll Files or Data

Certain financial files related to payroll inside your QuickBooks company file or directory could be ruined. Payroll files are needed for everything to function correctly and for updates to be handled.

- Wi-Fi and Internet Outage

When QuickBooks is not able to download the important update files due to a revolving internet connection, this is often the fault of the network, rather than a particular 557 error code.

- Problems Related to Firewall or Antivirus

Firewalls and antivirus software are used to keep malicious viruses and threats from accessing your computer. But some cases may include Malware incorrectly blocking the authorised QuickBooks update process.

- Incorrect date and time

When your computer’s time or date is incorrect, it can cause you to fail to log in with Intuit because the servers view these errors as security risks.

- Server-Side Issues

The problem may sometimes be caused by issues on Intuit’s servers. Problems with update servers can cause error messages for any users trying to install updates.

Symptoms of QuickBooks Payroll Error 557

Recognizing the symptoms of QuickBooks Error 557 is crucial for timely intervention. Generally, people who use technology meet these challenges.

- Failure to Update Payroll Tax Tables

The clearest sign is that QuickBooks does not allow you to update your payroll tax tables. You will probably get the “Error 557” message as soon as the update starts.

- Payroll is not processed correctly.

Since the tax tables haven’t been updated, QuickBooks will generate wrong payroll tax amounts. For this reason, companies may make errors withholding taxes and risk breaking the law.

- QuickBooks Desktop Crashing or Freezing

On certain days, when you notice issues deeper in your QuickBooks installation, the app might become unstable or crash while handling payroll.

- Slower Speed in QuickBooks

An unrecognized system or QuickBooks issue behind Error 557 can also cause the software to work more slowly.

- Error Messages Appearing Repeatedly

You might get the “Error 557” message when you try to update payroll all the time. Even before you start QuickBooks, it will check for updates by itself.

Preventive Tips to Avoid QuickBooks Error 557

Proactive steps can significantly reduce the likelihood of encountering QuickBooks Error 557 and other update-related issues.

- Always Keep Payroll Subscription Active

Prevention is best achieved by always renewing and maintaining your QuickBooks Payroll payment. Set reminders or have your membership automatically renew far before your subscription ends.

- Regular system and QB Updates

Updating your Windows and QuickBooks Desktop regularly should become a routine task. Some of the updates for Windows include security updates and changes that let different programs work together. Updating your QuickBooks system deals with issues and makes it work better.

- Backup Company Files before Updating

Before performing any major QuickBooks update, whether changing versions or manually updating payroll, it’s important to back up your company files. This ensures that you can recover if there are any complications with the upgrade.

- Keep Your Internet Up and Running

Your PC must have a strong and consistent internet connection. You should refrain from updating your device while you’re not on a reliable connection.

- Review Settings of Firewall/Antivirus

Check the security settings of your software if it is blocking QuickBooks from doing what it has to.

- Monitor QuickBooks Notifications

Don’t miss any notifications on QuickBooks Desktop about updates or subscription renewals.

Conclusion

QuickBooks Error 557 can severely impact business operations, especially those reliant on timely payroll processing. If you know the reasons, spot the symptoms and use step-by-step instructions, you should fix this problem. Regular upkeep, installing updates and managing subscriptions will stop such errors from occurring.

Frequently Asked Questions

Q 1: What is the most common reason for QuickBooks Error 557?

Ans: The most common reason for QuickBooks Error 557 is an expired or inactive QuickBooks Payroll subscription. A suspended or expired subscription will prevent QuickBooks from getting the updated payroll tax tables.

Q 2: Am I able to use the payroll service if I have Error 557?

Ans: Though you might manage to do payroll, experts suggest you refrain from doing so. A payroll tax error like 557 means your tables haven’t been updated; this could cause your calculations to be incorrect and result in problems with fines or penalties from the government.

Q 3: How long does it take to fix QuickBooks Error 557?

Ans: The time to fix error 557 in QuickBooks varies. If it is an out-of-date subscription you are having an issue with, it can be renewed within minutes. Some serious issues, such as damaged installations or software collisions, can be resolved after multiple hours, especially when a reinstall is required.

Q 4: Is there any chance that Error 557 could harm my existing payroll information?

Ans: Mainly, Error 557 can be resolved through updates to the payroll tax tables and to QuickBooks. Your present employee data, payroll records and paychecks shouldn’t be changed. But before you start major fixing, always save a copy of your company file somewhere safe.

Q 5: What should I do if I’ve tried everything and the Error 557 still appears?

Ans: If you’ve diligently tried all the solutions and the QuickBooks payroll update error persists, it’s recommended to contact QuickBooks Desktop customer support. They use the most modern tools to make sure the help they offer is targeted for each patient. Such instances can happen due to operating system malfunctions or an application running into special conflicts.

Q 6: Can Error 557 be solved with QuickBooks File Doctor?

Ans: QuickBooks File Doctor is developed primarily to solve company file issues and network issues. Although it can pretty well solve some other underlying problems leading to Error 557 QuickBooks desktop, it doesn’t really fix payroll subscription problems directly. It’s a helpful feature to include when performing advanced troubleshooting.

Q 7: Could slow internet speed be the reason I keep getting Error 557?

Ans: While less specific to QuickBooks Error 557, an unstable or unreliable internet connection can prevent QuickBooks from successfully downloading any updates, including payroll tax tables. Updating your system should be done when you are on a secure internet connection.

Adams Williams

Adams Williams is a seasoned accounting professional with over 4 years of experience in bookkeeping, financial reporting, and business accounting solutions. Specializing in QuickBooks software, Adams combines technical expertise with clear, accessible content writing to help businesses streamline their financial processes. His insightful guides and how-to articles are crafted to assist both beginners and seasoned users in navigating accounting software with confidence.