Unvoiding a check means undoing the check that you have voided. When you have some voided transactions and you want to unvoid them due to some reasons, then you can do it by simply re-entering the amounts. If there is a void transaction in the checkbook it means the amount of the transaction is set to zero but that transaction is not deleted.

Table of Contents

- 1 What Does It Mean to Unvoid a Check in QuickBooks?

- 2 Why it is Important to unvoid a check in QuickBooks?

- 3 What to do Before Unvoiding a Check in QuickBooks?

- 4 How To Unvoid a Check in QuickBooks Desktop?

- 5 How To Unvoid A Check In QuickBooks Online?

- 6 How to Undo a Voided Transaction by Re-entering the Transaction?

- 7 Final Words

- 8 Infographics to Unvoid A Check in QuickBooks

- 9 Frequently Asked Questions

- 9.1 Q 1: Why it is Important to Void a Check Properly?

- 9.2 Q 2: Can Voiding a Check in QuickBooks be Undone?

- 9.3 Q 3: Can I Unvoid a Transaction in QuickBooks?

- 9.4 Q 4: Can you Unvoid a Payment in QuickBooks?

- 9.5 Q 5: Is it Possible to Unvoid a Voided Check?

- 9.6 Q 6: What is the Journal Entry for a Voided Payroll Check?

What Does It Mean to Unvoid a Check in QuickBooks?

The process of reversing a previously canceled check’s void status and bringing it back into an active position inside QuickBooks is known as Unvoiding a check.

This QuickBooks feature has a big impact on financial record-keeping and accounting accuracy. A cheque that is unvoided reactivates the initial transaction, maintaining the accuracy and consistency of the financial data. In general, voiding checks makes it possible to properly reconcile and monitor accounts, offering a smooth audit trail for transactions. To streamline this process and help businesses manage their check transactions and keep correct financial records, QuickBooks is essential.

Why it is Important to unvoid a check in QuickBooks?

The need to unvoid a check in QuickBooks can occur in several ways, most frequently as a result of the need to correct mistakes, update data, or attend to certain financial management obligations.

For example, a known situation for unvoiding a check will be when a wrong payee was recorded initially, or when you had to adjust the check amount because of a billing adjustment. In such a situation, QuickBooks plays a vital role in allowing users to reverse the particular voided check and make the required rectifications easily.

This particular ability not only increases precision in the financial records but also simplifies the total management of the finances of a company, making sure the errors are corrected promptly, and keeping the financial process intact.

Read this: How to Set up Reminders in QuickBooks

What to do Before Unvoiding a Check in QuickBooks?

Before unvoiding a check in QuickBooks Desktop or Online, you need to check the points listed below:

- First, Open QuickBooks Desktop and find the transactions.

- After finding the transactions open them.

- Now, click on more at the bottom bar.

- After that, click on the audit history option.

- Then, click on the right on the top of the screen, and choose the show option.

- Now, you can see all the edits and original information of the transaction.

How To Unvoid a Check in QuickBooks Desktop?

If you are also looking to unvoiding a check then it is not possible. But there is one thing that you can do Audit log. This feature is used to enter your details again correctly.

To use the Audit log feature the steps are as follows:-

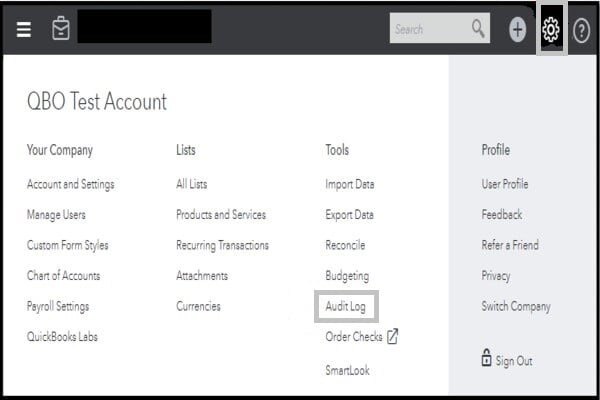

- First of all, go to the Gear icon in your QuickBooks Desktop account.

- From the drop-down menu, select the Audit log option that is under the Tools.

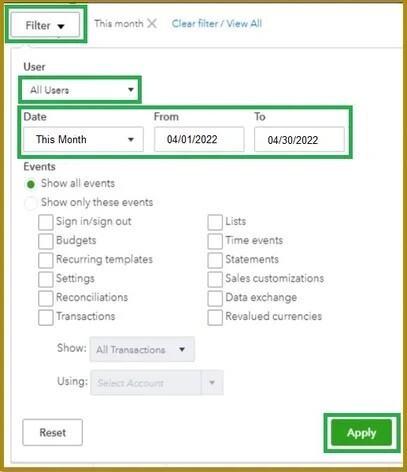

- Then from the Filters option, choose the User Date and Events Filters.

- Select the Apply button.

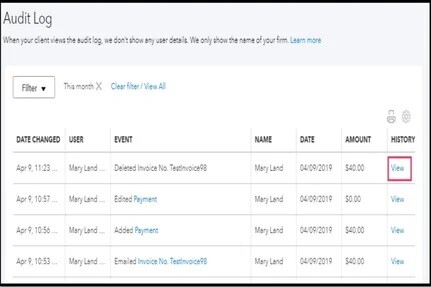

- Search for the voided invoice.

- Then in the History column, click on the button View.

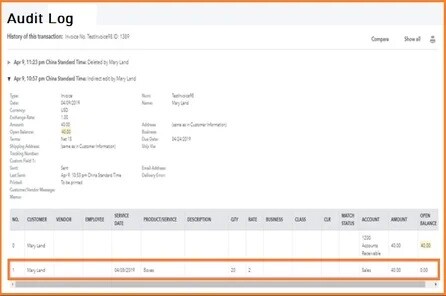

- Create the new invoice and when you are done then you have to use the information mentioned in the Audit History.

- Now you are done.

To guarantee that the changed check status is implemented permanently in QuickBooks Desktop’s accounting records, this last step is essential. By saving the particular changes, you strengthen the adjustments done, upholding precise financial documentation.

To ensure that the right information is recorded in the system and to address any disparities in the financial records, the voided check reversal is crucial. By finishing this step, you ensure that all required adjustments are recorded and kept in QuickBooks Desktop, effectively closing the loop on the modification process.

How To Unvoid A Check In QuickBooks Online?

- Open QuickBooks: First of all Open your QuickBooks software.

- Head to Accountants & Taxes Option: Then click on the Reports tab and select the Accountants and Taxes option from the context menu.

- Copy The Transaction Amount: Next, navigate to the voided transactions and you need to copy the transaction amount.

- Select Chart of Accounts Option: Further, click on the Lists menu and select the Chart of Accounts option.

- Open The Account Register: Now double-click on the accountant tab to open the account register that consists of the voided transaction.

- Click on The Register: Then you need to click on the register so that you can see the voided transactions.

- Enter The Amount: Next, enter or paste the amount of the original transaction.

- At Last Save Button: Once you have done this click on the Save button.

- Issues Faced By Users: Some people encounter issues like how to unvoid a cleared check that was voided by mistake.

- Or Can the Voided Check be Reused: So to solve these issues, you can always take the help of our SMB professionals.

How to Undo a Voided Transaction by Re-entering the Transaction?

- Firstly launch your QuickBooks Desktop.

- Then you need to search for the transactions and open it.

- Next, go to the bottom bar and click on the More tab.

- After that click on the Audit history option.

- Now go to the top right side of the screen and click on the Show All button. Here are all the edits and the original details for the transaction.

- As soon as you get the transaction information you can make use of the back button from the browser and you will be directed to the screen where you can re-enter all the information.

Final Words

We hope that after reading this entire article, all your queries regarding how to unvoid a check in QuickBooks are clear. In this article, we have highlighted all the key points related to the topic, like what unfolding a check is, the important steps needed to implement to unvoid a check, etc. Still, for those of you who are new to this accounting software or lack the technical expertise to deal with technical issues, it is highly recommended to get in touch with our team of QuickBooks experts.

Infographics to Unvoid A Check in QuickBooks

Frequently Asked Questions

Q 1: Why it is Important to Void a Check Properly?

Ans: Incorrect checks can expose businesses to check fraud, which is why it’s critical to properly void a check instead of just deleting it. Once the transaction has been voided in QuickBooks, the paper check should be safely filed or destroyed.

Q 2: Can Voiding a Check in QuickBooks be Undone?

Ans: Voided checks can be easily reverted or undone to the original transaction. Once you delete a check then all the information related to checks will be deleted from the register as well. If there is no record or information of the check was created then the process cannot be undone except in the audit trail.

Q 3: Can I Unvoid a Transaction in QuickBooks?

Ans: There is no automatic way to reinstate a voided transaction. However, you can open and view most of the information for the transaction, and then just re-enter the transaction manually.

Q 4: Can you Unvoid a Payment in QuickBooks?

Ans: Yes, When you void a check in QuickBooks, you assign a value of zero to the check, but the check itself remains in the system. Consequently, it is still possible to modify the check and input a new value.

Q 5: Is it Possible to Unvoid a Voided Check?

Ans: There is an audit process that lets you edit the transaction information. You can use this to reverse a check that was unintentionally canceled.

Q 6: What is the Journal Entry for a Voided Payroll Check?

Ans: Delete the voided check from the list of pending checks if a voided check was written in a previous month and write a journal entry to debit Cash and credit the account that was debited when the check was originally recorded.