QuickBooks Payroll Error PS058 occurs when the software is unable to download payroll updates. This issue prevents the update procedure and interrupts the payroll operations. It often arises on account of a corrupted installation, damaged company files, or problems with internal parts.

One easy way to resolve this payroll issue is to reinstall the QuickBooks software to fix any corrupted files. But, users must first determine the right cause prior to selecting a solution. Understanding the cause helps solve the issue and stops it from recurring.

Comprehending the PS058 error assists users in ensuring that the payroll processing is correct. It also assists in preventing delays while using direct deposit to pay the employees. In this guide, complete information on this payroll error has been shared. This guide includes the causes and effective troubleshooting steps to fix the PS058 error with ease.

Table of Contents

- 1 What is QuickBooks Payroll Error PS058?

- 2 Causes of QuickBooks Error PS058

- 3 How to Resolve QuickBooks Payroll Error PS058?

- 4 Conclusion

- 5 Frequently Asked Questions

- 5.1 Q 1: What are the Signs and Indications of QuickBooks Error PS508?

- 5.2 Q 2: How to stop QuickBooks Error PS508 from occurring in the future?

- 5.3 Q 3: Can the QuickBooks error PS508 be triggered by a corrupted QuickBooks company file?

- 5.4 Q 4: Can payroll error PS508 get triggered due to a third-party antivirus or security software?

- 5.5 Q 5: Is it possible to proceed with payroll processing despite the error PS508?

- 6 Adams Williams

What is QuickBooks Payroll Error PS058?

QuickBooks Error PS058 arises when the user attempts to install or download the payroll updates. These issues disrupt the payroll processes and can prevent users from performing daily tasks.

The payroll error PS058 prevents payroll updates, triggering salary delays, leading to dissatisfaction among the employees. Furthermore, it prevents tax table updates, triggering incorrect payroll deductions and legal issues. Resolving it is time-consuming and impacts productivity.

Struggling With Accounting or Bookkeeping?

Talk to our experts in minutes — No wait time!

- Free Consultation

- Fast Response

- Trusted Experts

Causes of QuickBooks Error PS058

Many factors can give rise to the error PS508 in QuickBooks Desktop. Here is the list:

- Windows system files are needed when QuickBooks is not working properly.

- Antivirus or firewall stops the payroll system updates.

- In the company file, the wrong Employee Identification Number is used.

- A damaged or corrupted QuickBooks company file.

- The QuickBooks file is saved on a different drive, not the C: Drive.

- The payroll subscription is not working or has expired.

Each of the reasons impacts how QuickBooks manages the payroll updates. Determining the exact reason enables the user to implement the right solution.

How to Resolve QuickBooks Payroll Error PS058?

Several factors trigger the QuickBooks Error PS058. Hence, it is crucial to follow an efficient step-by-step troubleshooting procedure. Begin by downloading the current version of QuickBooks Desktop.

Here are the different solutions to fix the QuickBooks Payroll Error PS058 and resume business operations:

Solutions 1: End Background Programs Using Task Manager

To fix the payroll error PS058, end all the active background programs with the help of Task Manager. Follow these steps:

- Shut down the QuickBooks Desktop.

- Now, click the keys “Ctrl + Alt + Del” together and start the Task Manager.

- In the “Processes” tab, find and choose the options qbdagent2001.exe and qbupdate.exe.

- Now, press the “End Task” option.

- Enter “Reboot.bat” in the search bar. Now run the particular file.

- The command prompt will open quickly and shut down on its own.

- Now reboot the system.

- Open the QuickBooks software and then install the current version of the payroll update.

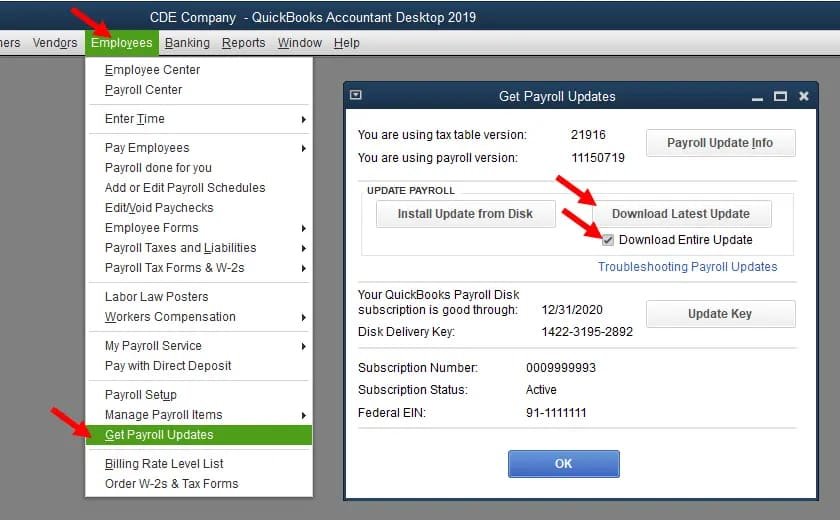

Solution 2: Download Payroll Update Again

An error during installation may mean the update file is incomplete. Here are the steps to download the payroll update again:

- Start the QuickBooks program.

- Head to the “Employees” option.

- Now, click the “Get Payroll Updates” option.

- Choose the checkbox, “Download Entire Update”.

- Press the option “Download Latest Update”.

- Allow the update to finish.

Once the download is complete, attempt to complete the payroll update process again. This steps often fixes the problem in case the issue is triggered due to corrupted update files.

Solution 3: Review the Payroll Service Subscription

Wrong or outdated subscription information can lead to error PS058. Here are the steps to check the payroll service subscription:

- Start QuickBooks Desktop.

- Press the “Employees” tab.

- Choose the “My Payroll Service”.

- Now, click the option “Manage Payroll Service Key”.

- In the “Add Payroll” screen, make sure the 12-digit Payroll Key is entered correctly.

- Press the “Next” button and then press the “Finish” button.

- Head to the “Help” option.

- Now, click the option “Manage My License” and then click the “Sync License Data Online” option.

To restart a paused Payroll Subscription, follow these steps:

- Press the “Employees” tab.

- Head to the “My Payroll Service” option. Now choose the option “Account/Billing Info”.

- Sign in with the Intuit login details.

- In the “Status” section, press the option “Re-subscribe” and complete the guidelines given.

Solution 4: Check for Errors in the Company File

Corrupted or damaged company files often trigger the error PS058. Here are the steps to check for errors in the company file:

- Start the QuickBooks program.

- Click the keys “Ctrl+1”. You can also click the “F2” key to start the Product Information screen.

- Click the keys “Ctrl+2” together. You can also press the “F3” key to start the “Tech Help” screen.

- Press the “Open” tab.

- Locate and press twice the file qbwin.log f.

- Click the keys “Ctrl + F”.

- Now type “Error” and click the “Enter” button.

- Record the error codes and follow the log to fix the issue.

- In case there are no errors, move to the next step.

Note: This solution helps to classify file-level errors that may disrupt payroll updates.

Solution 5: Run the Reboot.bat File

This solution helps to restart QuickBooks background services. Here are the steps:

- Start the Task Manager with the help of the “Ctrl + Alt + Del” keys.

- Head to the “Processes” tab.

- Complete all the processes concerning QuickBooks.

- Press the “Start” button. You can also click the “Windows” key.

- Enter reboot.bat in the search bar. Now, click the “Enter” key.

- Double-click the reboot.bat file and allow it to complete.

- After the process is complete, shut down the screen.

- Now reboot the system and download the current payroll tax update.

Solution 6: Use the RegCure Utility

All the update errors and registry issues that can stop payroll updates can be resolved using RegCure.

Here are the steps:

- Click the keys “Ctrl + Alt + Del”.

- Now open the “Task Manager”.

- Look for qbdagent.exe and qbupdate.exe in the “Processes” tab.

- Complete both processes.

- Run the Start menu and look for reboot.bat.

- Press the file twice to run it.

- A DOS-style window will open during the process and close on its own when done.

- Wait till it completes, and then reboot the system.

Conclusion

The solutions stated above can help resolve the QuickBooks error PS508 related to payroll update. These solutions resolve issues at both the system and software levels. In addition to the solutions, the causes that trigger this error are also mentioned.

In case you still have doubts or require professional assistance, feel free to reach out to us at smbacccountants.com.

Frequently Asked Questions

Q 1: What are the Signs and Indications of QuickBooks Error PS508?

Ans: Here are the symptoms of the error PS508:

- The payroll update procedure suddenly stops or is unsuccessful.

- Payroll features cannot be used.

- During the payroll update, error code PS508 is displayed.

- Paychecks show as “Online to Send” and do not process further.

- QuickBooks cannot download the current payroll updates.

Q 2: How to stop QuickBooks Error PS508 from occurring in the future?

Ans: To prevent the occurrence of error PS508 in the future, follow these points:

- Regularly update QuickBooks.

- Ensure the internet network is stable.

- Maintain an error-free company file.

- Do not store files outside the C: Drive.

- Access only reliable payroll services to minimize update failures and data problems.

Q 3: Can the QuickBooks error PS508 be triggered by a corrupted QuickBooks company file?

Ans: No. QuickBooks error PS508 is related to an unsuccessful payroll update. This does not confirm any file corruption. But corrupted company files can give rise to other payroll issues, hence they should be monitored regularly.

Q 4: Can payroll error PS508 get triggered due to a third-party antivirus or security software?

Ans: Yes. Often, firewall software or third-party antivirus software prevent QuickBooks networks. It can stop payroll updates and give rise to Error PS508. To prevent such disturbance, include QuickBooks as an exception.

Q 5: Is it possible to proceed with payroll processing despite the error PS508?

Ans: No. It is not possible. You need to resolve the error prior to payroll processing. This issue prevents payroll updates that trigger old tax tables and wrong calculations. Processing payroll without fixing the error may lead to compliance issues, incorrect payments, or tax penalties.

Adams Williams

Adams Williams is a seasoned accounting professional with over 4 years of experience in bookkeeping, financial reporting, and business accounting solutions. Specializing in QuickBooks software, Adams combines technical expertise with clear, accessible content writing to help businesses streamline their financial processes. His insightful guides and how-to articles are crafted to assist both beginners and seasoned users in navigating accounting software with confidence.