Need to use an accounting platform and you are in a remote place wherein you get internet seldom or no internet QuickBooks has taken away your worries with Payroll disk delivery. If you are a QuickBooks user with no internet then you don’t have to worry as Intuit provides you an option to run QuickBooks without you being connected to QuickBooks online.

What is QuickBooks Payroll Service Key

Whenever you purchase or fresh download QuickBooks Payroll, a 16-digit PIN will be assigned to you according to the specificity of your EIN and payroll service. You must enter the Service key in QuickBooks. This will activate payroll services in the QuickBooks file.

What are the Limitations of the Payroll Service Key in QuickBooks?

The payroll service key in QuickBooks has the following conditions and limitations:

- All companies use the same payroll subscription

- From a registered desktop, you can access and use QuickBooks

- There is an error that states QuickBooks Desktop Payroll supports only a single data file with a unique EIN when you are working on multiple files using the same payroll subscription or EIN.

- For each company, ensure that the contact details and payroll administrator for the QuickBooks Payroll subscription are the same.

- By using the same payroll subscription, you can create several company accounts if your employees are paid via Direct Deposit.

Features of QuickBooks Payroll Service Key

QuickBooks Payroll is a cloud-based payroll service that helps businesses manage their payroll processing and tax filing. The service offers a variety of features, including:

- Online access: QuickBooks Payroll can be accessed from any internet-connected device, making it easy to manage your payroll from anywhere.

- Automatic tax filing: QuickBooks Payroll will automatically file your federal, state, and local taxes for you, saving you time and hassle.

- Direct deposit: QuickBooks Payroll offers direct deposit services, so you can pay your employees electronically.

- Payroll reports: QuickBooks Payroll provides a variety of reports to help you track your payroll expenses and ensure that you're complying with all applicable laws.

Benefits of QuickBooks Payroll Service Key

QuickBooks Payroll Service Key is a great way to streamline your payroll process and save time. With this service, you can easily manage your payroll data and keep track of employee information. In addition, the service provides accurate calculations and tax withholdings, which can help you stay compliant with federal and state regulations.

Automated Payroll Processing

Intuit’s QuickBooks Payroll Service Key is a cloud-based payroll solution that helps small businesses manage their payroll processes. The service key automates payroll processing, including the calculation of employee pay and the preparation of tax filings. It also offers employees the ability to access their pay stubs and W-2 forms online. QuickBooks Payroll Service Key is a scalable solution that can be adapted to meet the needs of growing businesses.

Easier Tax Filing

If you use QuickBooks Payroll Service, your taxes will be filed automatically. This can save you a lot of time and hassle, as well as help to ensure that your taxes are filed correctly.

Accurate Tax Calculation

As a business owner, you are responsible for ensuring that your employees are properly taxed. QuickBooks Payroll Service can help you calculate taxes accurately and efficiently.

With QuickBooks Payroll Service, you can:

- Easily calculate federal, state, and local taxes

- Print W-2 forms for your employees

- View payroll reports to see tax withholdings

QuickBooks Payroll Service makes it easy to comply with tax laws and ensure that your employees are properly taxed. With accurate tax calculation, you can focus on running your business and leave the worry to us.

Enhanced Security

Intuit, the makers of QuickBooks, have enhanced the security features of their online payroll service to protect your business data. They use state-of-the-art encryption and authentication technology to keep your information safe and secure. In addition, they have implemented a two-step verification process to ensure that only authorized users can access your account.

Follow These Steps To Find The QuickBooks Payroll Service Key

1: How to obtain your service key: -

you usually get the service key via e-mail. If you lack a service key, you can get it through an automatic service key retrieval tool. Here, you are required to sign in using your Intuit Account credentials. Contact us if you are still unable to retrieve the Service Key.

Here are some possible reasons why you are not receiving the service key.

- Multiple payroll orders may be there in your system for a particular company.

- Payroll products may be purchased from a retail store.

- The phone number that you have provided to Intuit does not match the number that you have provided in the account.

2: Open the QuickBooks Service Keys Window.

- If payroll service is not there in your company file, go to Employees --> open Payroll Services --> Enter Payroll Service Key.

- If you carry payroll service in the company file, go to Employees --> open My Payroll Service --> click on Manage Payroll Service.

3: QuickBooks Service Key Window:

- Click on Add, if payroll services are not enlisted.

- Click on Edit, if you have enlisted payroll services.

- Click on Edit, if a/payroll is enlisted.

- Select Edit, and don’t forget to note down the service key.

- Now, from QuickBooks Desktop, remove the payroll service

- Click on next.

- When the Payroll service message appears, click on ok

- Now, check that you have an active payroll subscription then click OK.

4. Add or Edit the QuickBooks Service Key:

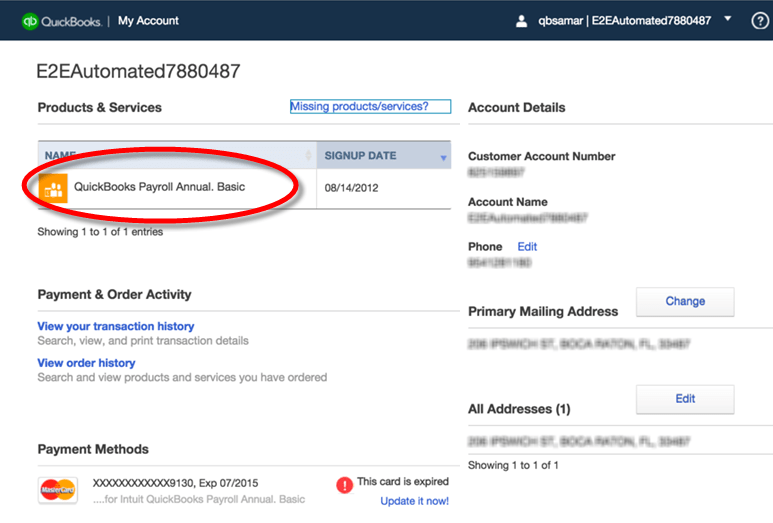

The Service Key for QuickBooks must be added if no payroll service is listed. (In the illustration below, there is no information regarding a payroll service.

QBDT Payroll Service Key Window is Empty

It will be listed in the window if you already have a Payroll Service. (Notice the green highlight bar illustrating the existing payroll product, in this case, QuickBooks Enhanced Payroll, with a status of 'Active'.) In these instances, you need to edit the payroll service to make changes.

QBDT Payroll Service Active Subscription

When you choose the option to Edit in the above window, QuickBooks will open the Enter Service Key window shown in the illustration below. (Note: For purposes of security, the actual service key has been redacted from this illustration, a live service key will be a 16-digit number.

QBDT Payroll Service Key Edit Window

- Select Next, then Finish, and enter or edit the correct Payroll Service Key. Select OK when the Payroll Update message appears. Verify that the Payroll Service is active and then select OK to close the Service Key windows and finalize all changes.

- If the Payroll Service Key needs to be removed, click the Remove button in the Payroll Service window. Select OK when the confirmation message appears to close the window.

What happens in case of a new update?

Now the question is when you are a QuickBooks user you need to update your accounting to the best and the latest versions available now if you have online or internet you just have to get the latest key and you are updated to the latest version however in case of no internet you have to order a new CD for Payroll disk delivery and you will be back to track.